Guest post by Next Gen Innovation Working Group.

Desmond Wan, Farah Miller, Linda Mitchell, Mah KC

Innovation & Sustainability

Over the last decade, the natural rubber industry has come under increasing pressure to be environmentally responsible since the 2015 Paris Agreement, which was again underscored after COP 26. The pressure is mounting on all sides, be it the consumers or the suppliers.

With the tire majors investing big in waste management and recycling of tires and growing legislative efforts globally on the producer’s side as a critical path toward building sustainability, it is creating considerable opportunities and challenges.

Meanwhile, rubber plantations expanded rapidly post the super-cycle of commodity prices in 2005.

Fast forward to 2022, in pursuit of a circular economy, the rubber industry is bucking up to bring sustainability throughout its supply chain. The governments of the rubber-producing countries and the tire majors have made significant strides forward. However, greater importance has to be placed on the development of the rubber-producing countries, primarily by ramping up the infrastructure and investments.

Supply chain needs rethinking of processes

Post the price boom in the 2000’s, rubber plantations saw an expansion of about 1 million ha between 2005 to 2011. However, once these new plantations entered production, a supply glut situation pushed the prices down.

Given the domination of the smallholders in rubber production, factors of prime importance include the location of future expansion along with the type of production system, yield, and overall efficiency. In addition, benefits for smallholders are vital as producers have to invest in sustainable production methods, and buyers should be willing to pay more for products with sustainable certification. This is of course in theory, but no one wants to or has foot the bill.

In addition, there is a potential impact of climate change factors like temperature and the duration of the winter, annual mean temperature, and annual mean precipitation.

This year, there is a threat of strengthening La Nina intensity which would be the two consecutive years – a likely impact of climate change. According to industry reports 2020, La Nina caused an increase in the accumulation of monthly rainfalls in Indonesia by 20 percent to 70 percent of normal conditions. Such conditions impact production and plantation health.

As a result, public policies and legislation support or industry partners is vital for the producers as it helps the producers increase their extent and diversify production to ensure a long-term stable supply.

Regulators stepping in

Exchanges are looking more at ensuring listed companies comply with sustainability practices. For example, SGX issued a rule in June 2016 that all companies listing on their exchange must prepare a sustainability report, citing a ‘comply or explain’ policy. [x] In the context of commodities, traceability has emerged as the most popular way to gauge the sustainability of a product.

Furthermore, the EU is passing a law where companies must verify that their goods sold in the EU were not produced on deforested land. There was strong pressure from the public to ensure the law did not limit proof to forests but all natural ecosystems. [x] Hence, rubber plantations and its associated actors in the supply chain, which have been routinely condemned by activist groups like Greenpeace, have once again come under scrutiny.

Such volatility in prices is concerning for long-term investments, especially when the essential cost is labour which does not fluctuate the same way. Moreover, given, natural rubber production is dominated by smallholders accounting for around 90% of the global production and rubber area, they are exposed to volatility. As a result, it becomes difficult for them to implement economic and production models sustainability.

Disconnect between innovation and sustainability

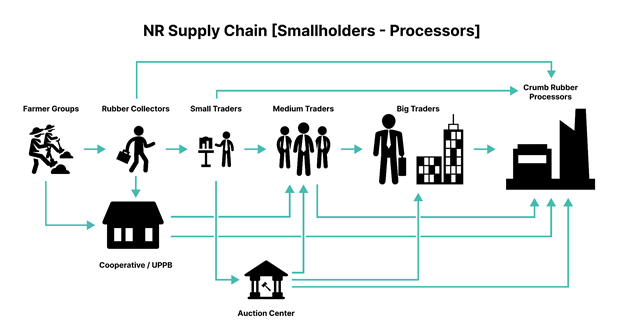

Innovation is key in traceability, especially in a commodity like rubber which has a notoriously convoluted supply chain. It is estimated that some origins of rubber goes through a minimum of 10 touch points. As over 70% of the world’s rubber production is consumed by tyre manufacturing, it is unsurprising that much pressure (and responsibility) falls on them.

However, there seems to be a disconnect between innovation and sustainability. Sustainability itself is an ill-defined concept because it is purely contextual. It is far too easy for big corporations to slap a certification sticker on their products and proudly announce their reduced carbon footprint. This top-down approach focuses on downstream actors when it is the upstream, where the smallholder sits, that is in dire need of more sustainable conditions. It is 6 million smallholder farmers who produce 85% of the world’s natural rubber that the industry needs to answer to. [x] A tyre manufacturer’s reduced carbon footprint, exchanges driven legislation and the EU’s deforestation law mean absolutely nothing to the smallholder farmer who lives on less than US$2 a day. [x]

Innovation is a double-edged sword at this point because of the large capital and resources it requires. To create a truly sustainable rubber industry, downstream actors need to begin empowering upstream actors through both education and funding. Local rubber councils and NGOs are stepping up to empower smallholders, such as the Malaysian Rubber Council creating a research fund for rubber [x]. However, there is still a vacuum in the technological expertise needed to create a system that can trace the smallholder farmers who are not associated with the robust traceability systems of tyre manufacturers. As of today, most of the industry still have a long way to go in tracing the millions of smallholder farmers who tap for multiple companies, highlighting the crucial need for innovation across the board, including independent private companies.