Author of the Blog: Ashish Govil, Global Head - Rubber, Olam International

Context:

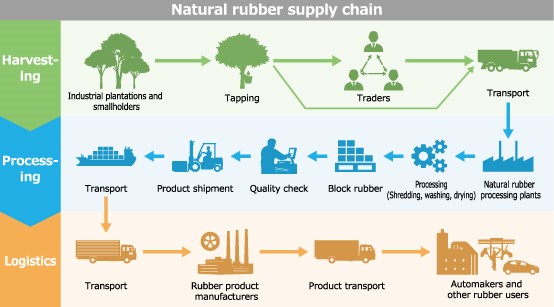

The world production of Natural Rubber is estimated at 13.5 million tonnes growing at an annual rate of 3%. Primarily a smallholder crop grown in Asia, about 70% of the rubber is consumed by the tyre industry.

Singapore has emerged as the world’s nerve centre for world rubber trading. Over last 5 decades it’s role in the industry has evolved into a merchant hub bridging diverse interests across the entire value chain.

Singapore hosts the central purchasing offices of International tyre makers like Michelin, Bridgestone, Goodyear, Continental, Pirelli, Giti, Apollo etc. Several of the largest local trading companies viz. Olam, R1, Namazie, Wilson, Singapore Tong Teik and Chinese Soes viz Grand Resource, Wuchan, Top Ship, HRG and Guangdong Guangken also trade through Singapore.

Rubber Trade Activities Conducted Via Singapore:

Desirability:

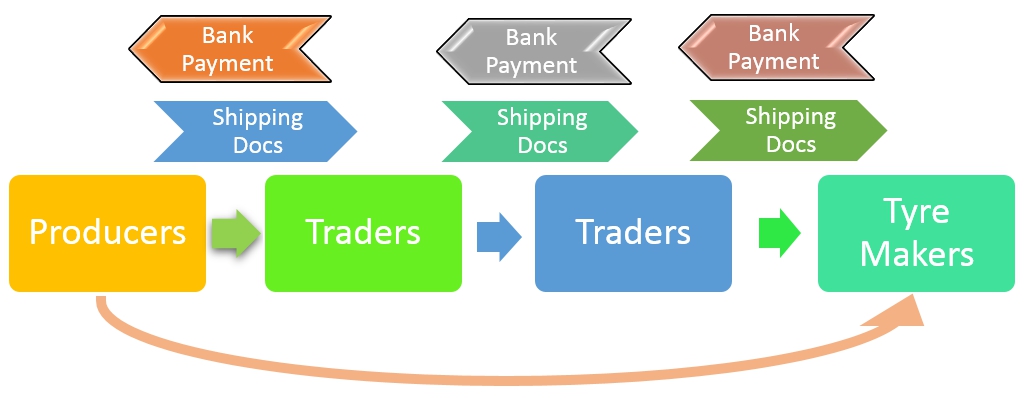

An estimated 70%-80% of the world rubber trade is conducted through Singapore annually, translating to about $10-11 billion of transactions conducted via Singapore banks.

The shipping voyage time can range from 8 days from Indonesia to 45 days from West Africa to customers around the world. This requires very quick turnaround of documentation to next set of buyers, courier and bank negotiations for payments. Due to restricted negotiation time lots of payments are on CAD basis reducing visibility for the banks and raising possibilities of multiple financing for same shipments. Participants also incur multiple transactions in courier costs, bank charges and staffing. Courier charges of $10-20, document staff processing of $80-100 and incoming bank collection charges of $20-30 per set are quite standard. Misplaced, lost in transit documents are some other risks that physical negotiation entails.

Funding risks for banks and costs for participants would substantially reduce if these documents were digitized and transacted securely and visibly online obviating the need for multiple handling and transmission from one participant to another.

With a move to WFH and conduct of transactions online, a pervasive risk of fraud and scamming has emerged. Scammers are hacking into email accounts of unsuspecting office staff, changing banking transfer instructions to defraud companies of millions of dollars. A more secure way of transacting and immutability of records would resolve this problem to a large extent.

Feasibility:

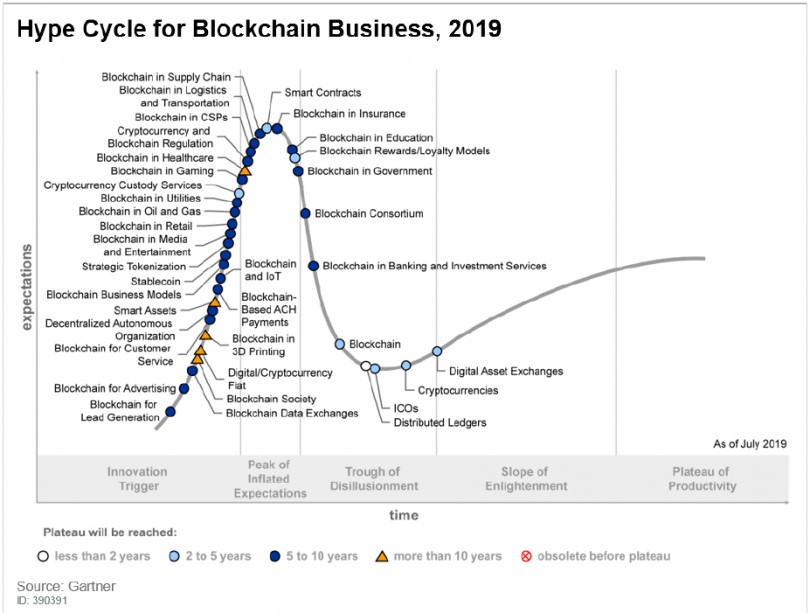

It is suggested that blockchain technology be harnessed to build the digitized platform. Blockchain ledger is the highly secured technology which is powering cryptocurrency and trade transactions platforms already around the world.

It is comparable to a highly secure shared access folder across designated organizations in a contract. Documents can be loaded by shippers and each subsequent actor can securely access and accept the documents triggering the next link in chain to perform the same function. Ideally therefore, one set of documents can be viewed by all participants in a transaction and banks can release payment directly once their client approves online.

Singapore can continue to consolidate its’ dominant place in the rubber industry by moving to a digitized rubber transaction platform using blockchain ledger technology.

Viability:

Rubber transactions conducted on a digitized platform would cut costs of $250-300 per set routed through one intermediary. Size of standard BL is 5 TEUs, 100 Mt or about $150,000 in value. Shaving off 0.15 to 0.2% in costs is a huge gain for the entire industry as well as completely avoiding multiple funding by banks for the same cargo.

Winnability:

Over the last several years rubber prices have fallen to an all time multi year low price of $1000 leaving farmers destitute and creating a sustainability challenge for the entire industry. Any savings in costs from efficiencies will eventually trickle down to farmers and benefit the entire value chain.

Rubber sustainability certification is the other need of hour. GPSNR is working on it as an industry initiative under WBCSD. Certifications requires a Chain of Custody (CoC) system to be installed across the supply chain and this digitized platform can allow these CoC to be further transmitted on to end customers like the automakers without any further interventions.

Risks mitigated by digitization on blockchain:

The benefits of using blockchain for the supply chain

Since blockchains are designed as distributed systems, they are highly resistant to modification and can suit very well on supply chain networks. A blockchain consists of a chain of data blocks, which are linked through cryptographic techniques that ensure the stored data cannot be altered or tampered with - unless the whole network agrees.

Therefore, blockchain systems provide a secure and reliable architecture for conveying information. Although often used for recording cryptocurrency transactions, blockchain technology can be extremely useful for securing all kinds of digital data, and applying it to the supply chain network can bring many benefits.

a) Transparent and immutable records

Imagine that we have several companies and institutions working together. They may use a blockchain system to record data about the location and ownership of their materials and products. Any member of the supply chain can see what is going on as resources move from company to company. Since data records cannot be altered, there would be no question as to who the responsible party was if something goes wrong.

b) Costs

A lot of waste occurs through the inefficiencies within the supply chain network. This problem is especially prevalent in industries that have perishable goods. The improved tracking and data transparency help companies identify these wasteful areas so they can put cost-saving measures in place.

The blockchain can also eliminate fees associated with funds passing into and out of various bank accounts and payment processors. These fees cut into profit margins, so being able to take them out of the equation is significant.

c) Creating interoperable data

One of the most significant problems with the current supply chain is not being able to integrate data across every partner in the process. Blockchains are built as distributed systems that maintain a unique and transparent data repository. Each node of the network (each party) contributes to adding new data and verifying their integrity. This means that all information stored on a blockchain is accessible to all parties involved, so one company can easily verify what information is being broadcasted by the other.

d) Replacing EDI

Many companies rely on Electronic Data Interchange (EDI) systems to send business information to each other. However, this data frequently go out in batches, rather than in real-time. If a shipment goes missing or pricing changes rapidly, other participants in the supply chain would only get this information after the next EDI batch goes out. With blockchain, the information is updated regularly and can be quickly distributed to all entities involved.

e) Digital agreements and document sharing

A single version of the truth is important for any type of supply chain document sharing. The necessary documentation and contracts can be associated with blockchain transactions and digital signatures, so all participants have access to the original version of the agreements and documents.

The blockchain ensures document immutability, and the agreements can only be changed if all involved parties reach consensus. This way, organizations can spend less time with their lawyers going over the paperwork or at the negotiating table, and more time developing new products or promoting business growth.

Examples of initiatives in similar space:

https://www.ledgerinsights.com/china-enterprise-blockchain-trade-finance-63-billion/

https://www.ledgerinsights.com/blockchain-startup-processes-1-billion-trade-finance-dltledgers/