The outlook for the rubber economy in the face of COVID-19

June 25, 2020

Author of the Blog: Dr Hidde Smit, Consultant, Analysis and Forecasts for the Rubber Economy

Dr Hidde Smit has a vast international exposure and over 40 years experience in modelling and forecasting commodity markets, especially the market for rubber. During 2005-2009, he was Secretary-General of the International Rubber Study Group. He is now an independent consultant on analysing and forecasting the rubber economy. His clientele includes various stakeholders in the rubber sector ranging from tyre manufacturers to producers and traders of natural and synthetic rubber. Companies involved in investment-banking and asset-management also seek his advice. He prepares annual and quarterly reports on the outlook for the rubber market.

This Blog aims at analysing developments and presenting forecasts for the rubber market as a result of the COVID-19 crisis. Forecasts are presented for 2020Q2 and beyond. All data up to 2020Q1 are taken from IRSG publications. Forecasts are taken from the 2020Q2 quarterly bulletin prepared by the author. For further details see www.rubberforecasts.com. It is interesting to first briefly summarise what happened during the previous major crisis, the financial crisis of 2008-2009.

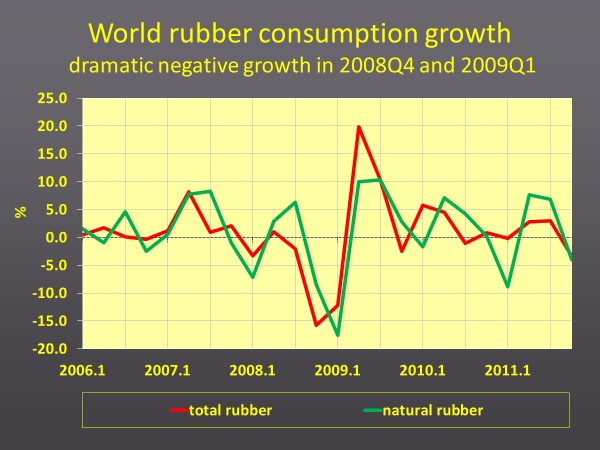

The financial crisis 2008-2009 and the consumer side of the rubber market

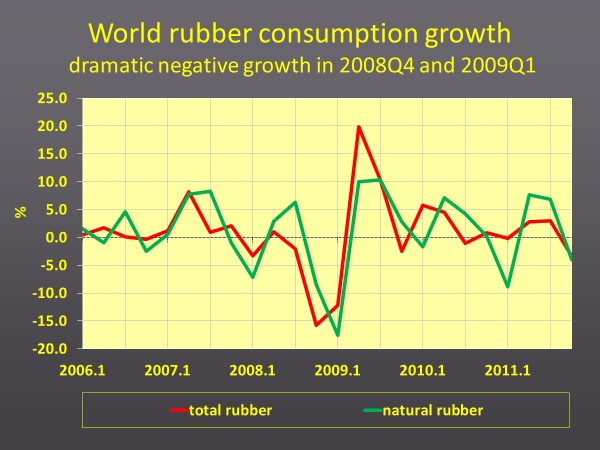

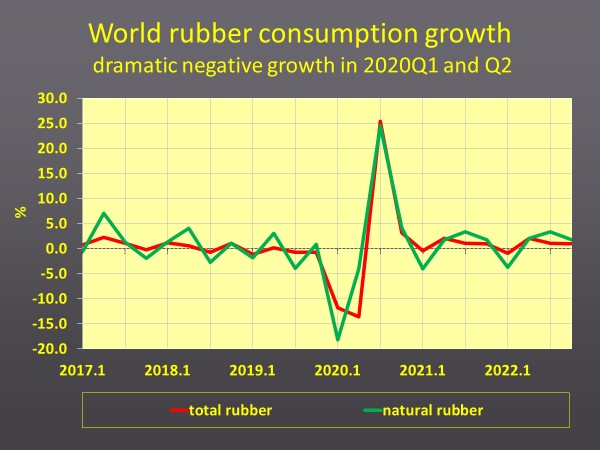

The financial crisis of 2008-2009 is clearly visible in Figure 1. The main reason for the negative growth rates of total rubber consumption (-15.8% and -12.2% for the two quarters 2008Q4 and 2009Q1 respectively) was financial uncertainty, leading to postponement of buying vehicles and tyres and reducing inventories to a minimum. This decline was compensated in 2009Q2 and 2009Q3 (increase of 20% and 12.4% respectively). In 2010Q1 the consumption reached the levels of early 2008 again. Figures for NR consumption are quite similar: -8.5% and -17.6% for 2008Q4 and 2009Q1 and 10.0% and 10.3% in 2009Q2 and 2009Q3.

Figure 1

The COVID-19 crisis and the consumer side of the rubber market

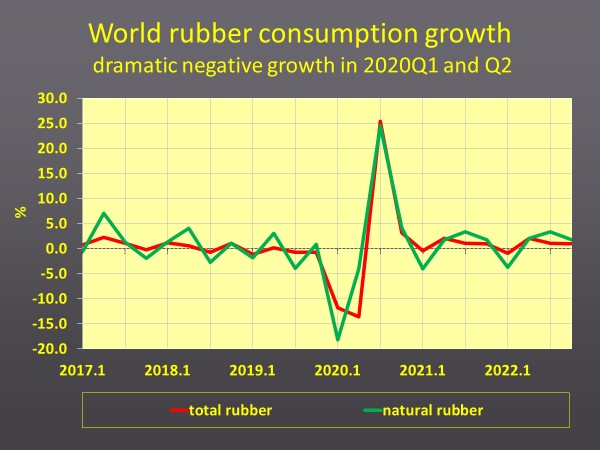

A broadly similar development as during the financial crisis is expected during the COVID-19 crisis. The difference is that most likely all special developments will happen in 2020; a decline of 11.9% in 2020Q1 and, on top of that, an estimated decline of 13.6% in 2020Q2, as can be seen in Figure 2. This represents a decline in consumption from 7.1 million tonnes in 2019Q4 to 5.4 million tonnes in 2020Q2. Moving back, consumption in 2020Q3 is projected to reach 6.8 million tonnes, an increase of 25.4%. This results for 2020 in a decline in total rubber consumption of 11.2% and in NR consumption of 10.6%.

Figure 2

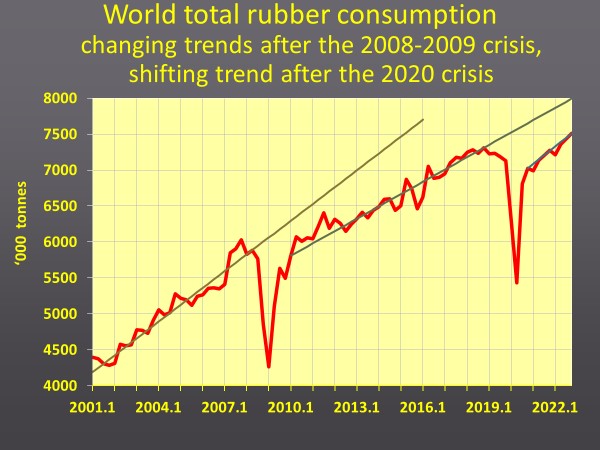

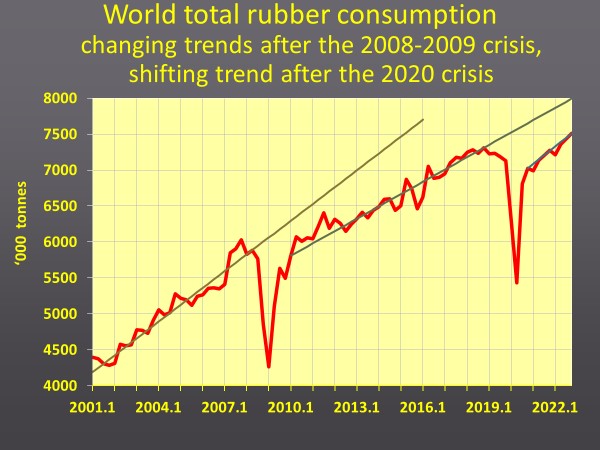

Figures 3 and 4 show data and forecasts from 2000 till 2022 for rubber and NR consumption. After each crisis the trends are changing, in most cases just shifting to a lower level. The shift in NR consumption after 2020 is relatively big.

Figure 3

Figure 4

The COVID-19 crisis and the NR producer side of the rubber market

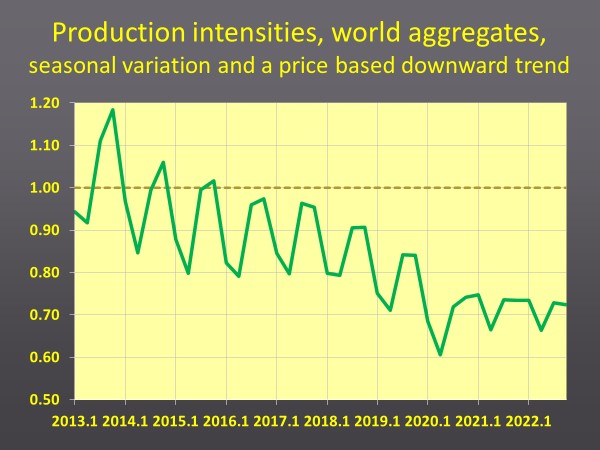

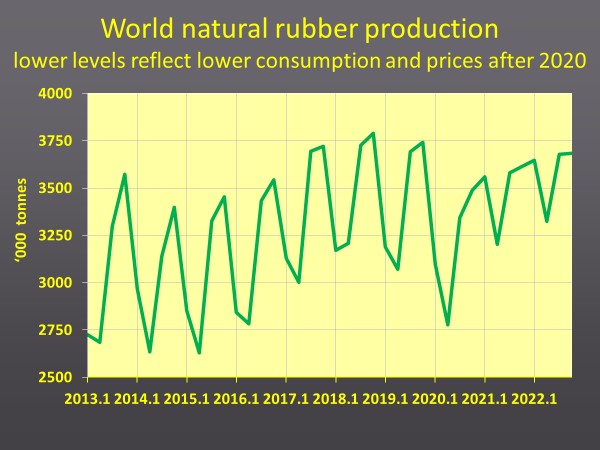

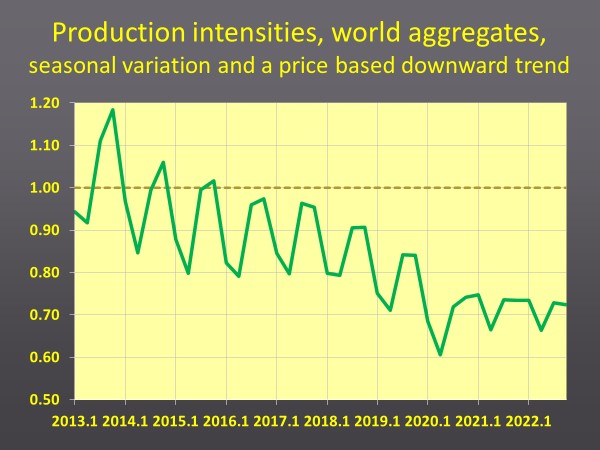

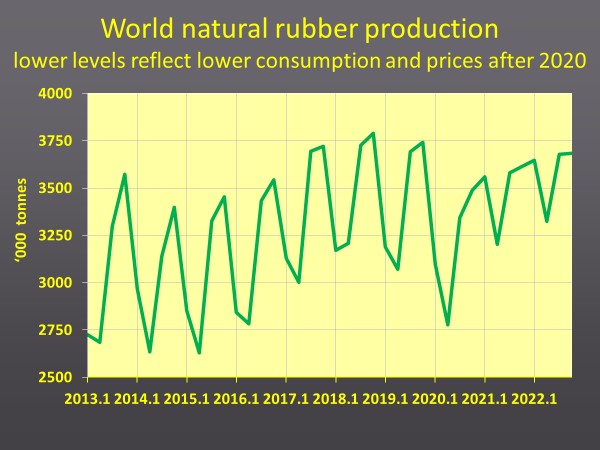

The crisis has led to a dramatic fall in NR prices, resulting in a decline in production intensity (PI). PI is defined as the ratio of actual production and normal production. Normal production is the level of production that would be reached if traditional tapping frequencies would be applied. PI will in general move in tandem with prices. As price forecasts cannot be presented in this publication, only PI forecasts are shown in Figure 5. The effect of the crisis is visible in Figure 6, where NR production data and forecasts are shown.

Figure 5

Figure 6

-End of Blog-

Blog Cover Photo Credits: IRSG Photo Competition 2019, Vu Phong - Daily Work